The holidays are here, and with them comes the tendency to overspend. Here are some tips to help you stay out of the red this New Year’s.

- Create a budget. Budget for everything, including cards, stamps, food for parties, decorations, holiday clothing, babysitters and teacher gifts. You may be spending more on non-gift items than you realize!

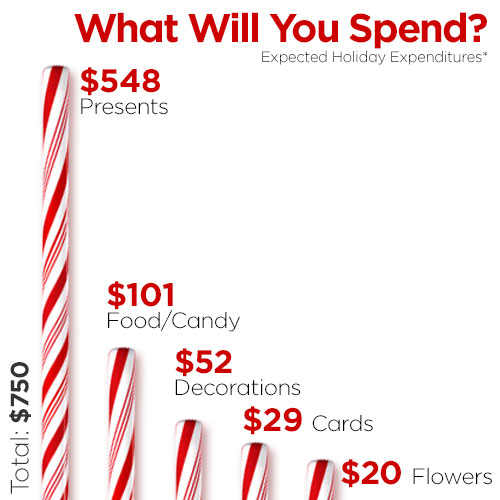

- Discuss the budget with your spouse or partner. Only 55% of people have done this,1 yet consumers plan to spend $750 on holiday gifts and decorations this year2 – a significant amount! (See chart below for spending breakdown.)

- Track what you spend. Overspending is so easy this time of year because we tend to lose track of what we have bought. When you write your purchases down as you make them, you’re less likely to overspend.

- Avoid the “trinket trap.” Try budgeting for one significant gift per recipient rather than picking up many smaller gifts along the way that really add up (and are harder to track).

- Leave cards at home. People tend to spend 12-18% more on average when paying with credit versus paying with cash.3 To avoid overspending, use cash or a debit card. And if you must rely on credit cards, bring only one—it’s easier to track your spending.

- “10 Tips for a Debt-Free Holiday,” Atlanta Parent, December 2012

- “Shoppers to Remain Conservative With Holiday Gift Budgets This Year,” National Retail Federation, www.nrf.com, October 17, 2012

- “Credit Card vs. Cash,” www.ehow.com, viewed December 5, 2012

*”Shoppers to Remain Conservative With Holiday Gift Budgets This Year,” National Retail Federation, www.nrf.com, October 17, 2012

Related

3 Comments

Comments are closed.

Leaving that debit card at home is a good idea. It will allow you to spend way more than intended.

This a great tips!

tough to do at xmas time. maybe have a budget for the whole year and allocate funds toward xmas so you can control spending and remain debt free the whole year.